Accounting software helps small businesses track their income and expenses, pay bills, manage inventory and create financial reports.

Accounting software can also be a valuable tool for business owners who want to keep their personal finances separate from the finances of their business.

In this article, I’ll show you how to choose the right accounting software for your small business.

What Is Accounting Software?

Accounting software is an automated system for managing money. It can help you track sales and expenses, make payments, calculate taxes and generate reports. Many accounting software packages also offer features like invoicing and inventory management.

Why do I need Accounting Software?

If you have a small business, you’ve probably thought about investing in accounting software. The benefits of a good accounting package are enormous: it’ll give you more control over your finances, save you time and money, and generally make life easier.

But with so many options out there—and so much to consider—it can be difficult to decide which one is right for your business.

Work in the UK? Check out Making Tax Digital

In the UK, the government is slowly bringing in the Making Tax Digital Regime (MTD). This aims to get all businesses and individuals to keep digital records, using software and submitting updates quarterly, bringing the tax system closer to real-time.

Currently, MTD is only required for VAT-registered businesses in relation to completing VAT returns. VAT returns are now submitted to HMRC through compatible software and all records must be kept digitally.

The next step in the MTD regime is to bring sole traders & landlords onto MTD by changing the way self-assessments should be completed and requiring digital records to be kept. Further down the line, this will also come in for limited companies as well.

Therefore getting onto software now will make this future transition a lot smoother. Most accounting software packages can handle these requirements, but check out what’s available before settling on one.

Which features do you need?

Identify what features you absolutely need. Do you want to be able to send invoices? How about track time and expenses, or pay employees? Also consider the reporting tools that are available, as well as their complexity.

Once you know this information, it’s time to begin evaluating software based on your own needs.

No more paper!

One of the best things about using accounting software is that it saves you time, money and stress. You won’t have to worry about writing down your expenses in a notebook, or entering them into a spreadsheet. If you get good systems in place it can all be done automatically!

And with accounting software, there’s less risk of errors because all the information is taken straight from the source (normally your bank or other integrations) and stored electronically. There’s no more chance of losing or misplacing receipts or invoices either; once you get them into the software it’s all digital now!

Did I mention how much better for the environment this makes things? Yup – reduced paper waste!

Training

What level of training is required? This can vary widely depending on your current knowledge base and how much time you want to invest learning a new system. If this is your first time working with accounting software, it’s probably best to go with a provider that offers video or webinar trainings or is more userfriendly.

Integrations

What integrations do you need? Do you need it to talk seamlessly to your CRM, Stripe or PayPal?

Most accounting software have a wide range of integrations with other apps but make sure you do your research into the specific integrations you need before making a decision.

Which Accounting Software is right for me?

Below I review the three main accounting software I’ve come across in my time as a small biz accountant: Xero, FreeAgent & Quickbooks.

Xero

Hands up if you’ve heard of Xero? You probably have if you’re in the small business world. Xero with QuickBooks is one of the more well-known accounting software out there.

Xero is a New Zealand-based software company and they have a range of offerings depending on what you need in your business. Let’s take a quick look at its core features for small businesses.

Integrations

Xero has been around a while and as such it’s racked up an impressive list of integrations. The integrations are normally very smooth and work well and so I normally recommend Xero to anyone with a lot of other systems because of the integrations available. Integrations that I find my clients use a lot are: Dubsado, Stripe, Zapier, GoCardless, Paypal, Dext, Autoentry, Shopify, etc

Notable integrations it doesn’t have: 17Hats, Etsy, Amazon business purchases.

Pricing

This is where I think Xero falls down a little. Now you might look at the starter package and think WOW £7 is amazing. But when you look at it it only allows you to enter 5 bills. Now chances are your going to have more than 5 bills a month so I’ve never actually had a client use the starter plan. Nearly everyone I’ve worked with has been on the standard plan and I’d only recommend premium if you need to use multiple currencies.

Also note these prices don’t include VAT so remember to add 20% if you are not VAT registered. Also, prices increase after the first 3 months.

Xero’s pricing is in the standard range of accounting software pricing so you won’t find too much difference to other offerings here.

User-friendliness

Xero is definitely built to grow with your business. It really can be the perfect accounting solution for a wide range of businesses. As such if you are starting out you won’t need to use everything that Xero offers and therefore it can seem overwhelming and you may need help setting it up. However, there is a database of guides and articles to help you navigate and learn how to use Xero to its full potential. Plus (SPOILER) I’ve built a course to help you navigate through and get the most out of Xero – see more info below.

Given Xero is built for a wide range of businesses I find it’s super flexible and you’re able to tailor it to your own business. For example, you can pretty much create any style of invoice you want so you don’t have to compromise on your brand guidelines to invoice.

You can set up automations within Xero to help speed things up, for example, you can set up bank rules so that if you have recurring transactions (e.g. monthly Canva subscription) it automatically allocates it for you. This saves you a lot of time whilst doing your bookkeeping!!

Features

Xero has the standard accounting software features, you can invoice, track bills, reconcile the bank account, run reports, etc.

One free feature to note is Hubdoc. Hubdoc is a receipt management system, you can upload or take photos of receipts and it will read them and get the information ready to input into Xero. This saves you A LOT of time and stores all of your receipts in one place so if you ever were audited by HMRC you could find everything you need easily.

Xero is MTD compatible for VAT & Income tax. Currently, you can’t submit self-assessments through Xero unless you’re an accountant but VAT returns can be submitted by anyone.

Additional paid features include things like: payroll, claiming expenses, tracking projects.

Summary

Rating: 8/10

Who’s it good for: Most small or medium-sized businesses who are planning to grow.

FreeAgent

FreeAgent is the new guy on the block. You might not have heard of them but they are creating waves in the small business world right now.

FreeAgent is a Scotland-based business, still relatively new and so far has mainly marketed through accountant word of mouth (hence why you might not have heard of them yet).

Let’s dive into the detail…

Integrations

So being newer than the other softwares on the market means they are behind on their integrations. They do still have a good list but it’s not as extensive as Xero or Quickbooks so definitely go check them out before making a decision. They do integrate with Stripe, Gocardless, Shopify, Paypal, Dext, Zapier and more.

Some of the integrations aren’t as slick as Xero or Quickbooks and they are lacking integrations with some CRM systems like Dubsado.

However anytime I’ve raised a possible new integration they’ve been engaged and looked into it so it’s definitely something they are working hard to improve.

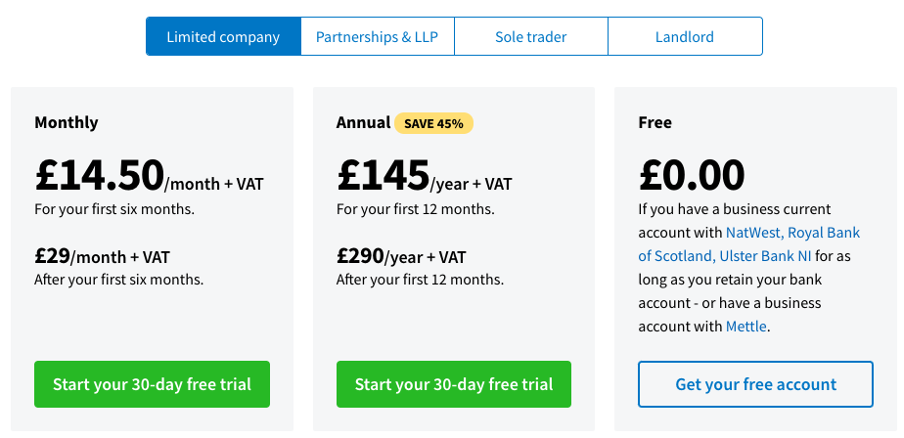

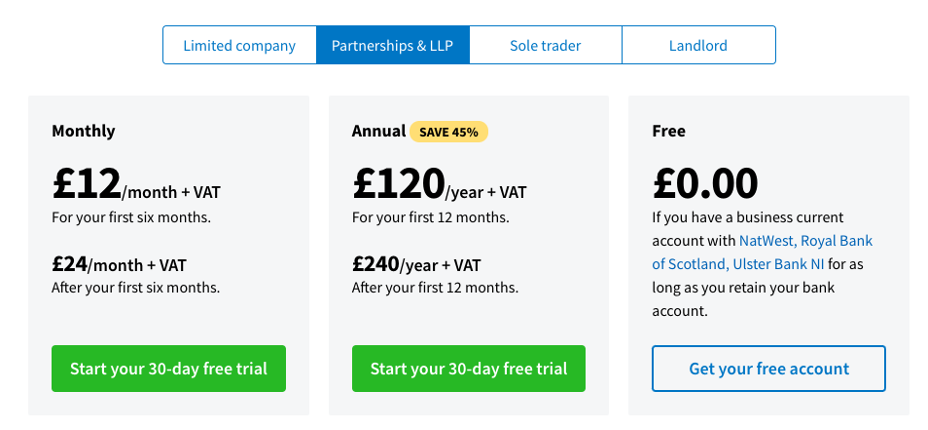

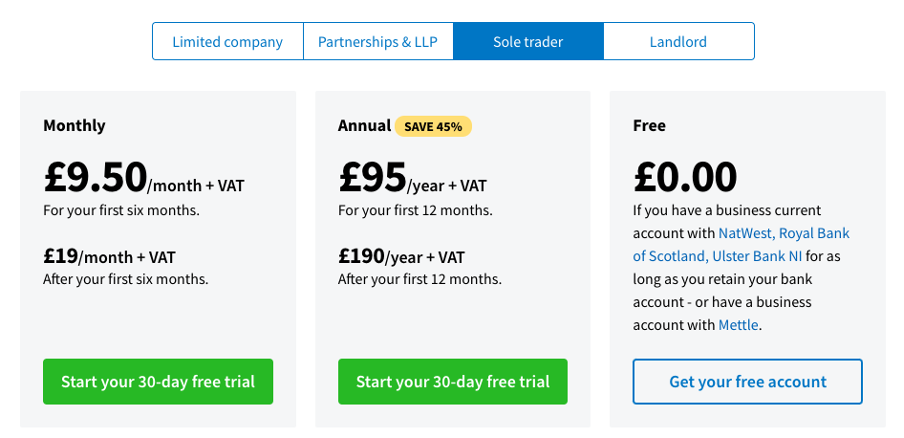

Pricing

So this is where FreeAgent hands down wins. You can get FreeAgent for FREE – yes that’s right for Free.

If you have a business current account with NatWest, RBS, Ulster Bank NI or Mettle you can get FreeAgent for free.

So if you bank with anyone of those banks – FreeAgent should be a no brainer.

If not FreeAgent packages are based on business structure. So you’ll get a different price for a Limited Company, Partnership or Sole Trader.

User-friendliness

FreeAgent have built the software with the end user in mind. They don’t use accounting jargon and instead keep it simple with phrases like money in, money out instead of debits and credits.

As with all softwares it takes some getting used to but FreeAgent have extensive guides, tutorials and trainings to get you up to speed with the software. Out of all the software I’ve come across it’s definitely the most user friendly for a non finance user and I get the same feedback from my clients.

However, given it’s newer it isn’t as flexible in some of it’s functionality, for example the options for invoice templates are limited and hard to change to follow brand guidelines.

Their support team are super helpful and friendly so if you do get stuck you’ll be in good hands.

Features

Again all the standard features are there with FreeAgent. They also have additional features included in the packages such as payroll, expenses, projects, timetracking, VAT returns etc.

They have a mobile app which enables you to scan in receipts which FreeAgent can read – a bit like Hubdoc for Xero.

If you’re a sole trader or a limited company you can submit your personal self assessment through FreeAgent. Note some parts of the self assessment aren’t yet supported like property, foreign income or capital gains but you’ll be fine with a straight forward SA.

FreeAgent has automations that help you get bookkeeping complete faster. It has AI that learns your transaction types to help you allocate the bank account faster. You can also set up automated payment reminders for your invoices.

Currently FreeAgent isn’t great at being able to import data into it. I.E. if you’re moving from another accounting system to FreeAgent – it can be a bit manual and time consuming to get the data in. If it’s your first time using the software then this won’t be an issue for you.

Also some of the more complex accounting features – fixed assets/inventory etc aren’t as smooth as some of the other softwares.

Summary

Rating: 7/10

Who’s it good for: Good for small businesses who are thinking of going onto software for the first time.

QuickBooks

Now I have an upfront confession. I don’t use Quickbooks in my business and neither do any of my clients. However it’s a popular software so I didn’t want to leave it out of the review.

Quickbooks is an american based company and I’m sure you’ll have seen the adverts for it on TV with the little people walking around. Let’s take a deeper look at it.

Integrations

Quickbooks like Xero has been around a long while and therefore has an extensive range of integrations. It seems to have the edge on integrations and maybe that’s helped by it being a US based company.

It has all the standard integrations mentioned in the other two above as well as: amazon, 17hats, Etsy and much more.

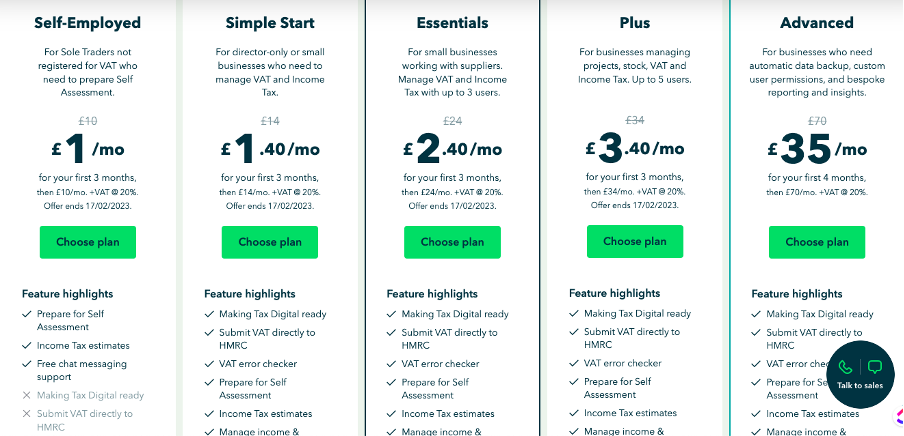

Pricing

Quickbooks has more flexibility in pricing than Xero but it can be a bit overwhelming choosing what package you need. Just remember you can always upgrade once your on a subscription.

Prices are in the standard range for accounting software with some good deals for the first three months.

User-friendliness

My experience of quickbooks is that it isn’t super user friendly. Most businesses that I’ve come across using quickbooks have been a mess with the person looking after it stuck not knowing how to fix it.

They do offer a free onboarding session to anyone on the simple start programme above and I would take them up on this as getting set up right is the first key to success with accounting software.

As with the other two softwares there are lots of free guides & walkthroughs so you can learn how to make the most out of it. If you want to use Quickbooks because of the integrations I would really suggest setting aside a good amount of time to really understand it and get to grips with everything.

Features

Again quickbooks has the standard invoicing, bills, reporting features. One feature that stands out to me is the VAT error checker – for VAT registered businesses this helps at spotting common errors before your submit your VAT return.

Payroll is an additional paid feature but included in every subscription is an income tax estimate feature which could come in handy. Having more users & being able to track projects only comes with the higher tier subscriptions.

Summary

QuickBooks wouldn’t be my choice but they are known for their support team & good integrations so if it’s the winner for you make sure you make use of this.

Rating: 6/10

Who’s it good for: Small to medium businesses with a need for certain integrations who are either working with an accountant or bookkeeper or have time to learn and get to grips with Quickbooks.

To summarise

If you’re looking to start your own business, or if you’ve just started one and are feeling a little overwhelmed by accounting software, don’t worry! I can help. I’ve worked with lots of small businesses and have seen the good and bad when it comes to accounting software. I know from experience that when people use the wrong tool for their needs, they end up frustrated or missing out on important features that could save time in everyday tasks.

To set you up & your business up for success with accounting software I have built a get to grips with Xero course. The course covers everything from setting up Xero from scratch to troubleshooting the usual issues & mistakes I come accross with clients & Xero.

If this sounds like something you’d be interested in then click the link below to join the waitlist.

Not sure where to start?

Grab my free guide to bossing your finances and saving for tax!